8 TTenant Screening Myths: Debunked!

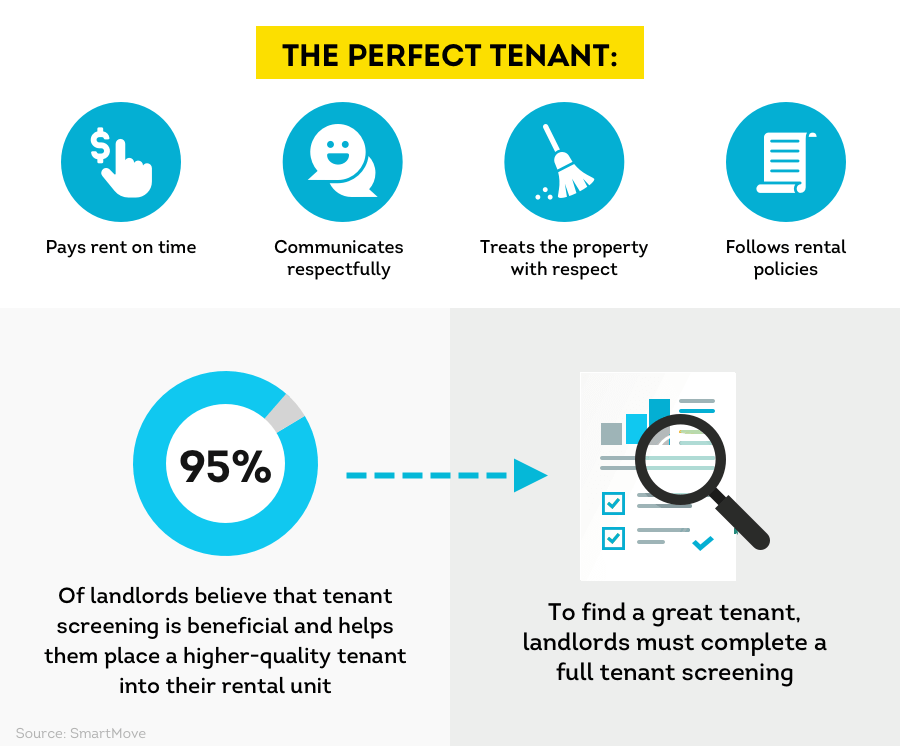

Myth #1: Go with Your Gut Most landlords know that using their gut to judge a person is not the wisest decision. According to a 2016 survey done by the TransUnions screening service, SmartMove, 86% of landlords said they verify an applicant’s information before signing a lease. However, there are still thousands of landlords a […]

8 TTenant Screening Myths: Debunked! Read More »

Myth #1: Go with Your Gut Most landlords know that using their gut to judge a person is not the wisest decision. According to a 2016 survey done by the TransUnions screening service, SmartMove, 86% of landlords said they verify an applicant’s information before signing a lease. However, there are still thousands of landlords a